LLC vs Sole Proprietorship: Which Business Structure is Better?

When starting a business, one of the first and most important decisions you’ll make is choosing the right business structure. Two of the most common options are forming a Limited Liability Company (LLC) or operating as a sole proprietorship. Both have their pros and cons, and the best choice depends on your business goals, budget, and risk tolerance. In this blog, we’ll compare LLCs and sole proprietorships to help you decide which structure is better for your business.

1. Liability Protection

One of the biggest differences between an LLC and a sole proprietorship is liability protection.

- LLC:

- Separate Entity: Your personal assets (home, car, savings) are protected from business liabilities.

- Limited Liability: If your business is sued or faces debt, your personal assets are generally safe.

- Sole Proprietorship:

- No Separation: Your personal and business assets are considered the same.

- Unlimited Liability: You’re personally responsible for all business debts and legal issues.

Pro Tip: If your business involves higher risks (e.g., handling customer data or physical products), an LLC is the safer choice.

2. Tax Flexibility

Tax treatment is another key factor to consider.

- LLC:

- Pass-Through Taxation: Profits and losses are reported on your personal tax return, avoiding double taxation.

- Tax Options: You can choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation.

- Sole Proprietorship:

- Simple Taxes: Income is reported on your personal tax return using Schedule C.

- Self-Employment Taxes: You’re responsible for paying self-employment taxes on all profits.

Pro Tip: If you want flexibility in how you’re taxed, an LLC is the better option.

3. Cost and Complexity

The cost and complexity of setting up and maintaining your business structure vary significantly.

- LLC:

- Higher Initial Costs: Filing fees for forming an LLC can range from $50 to $500, depending on the state.

- Ongoing Costs: Some states require annual reports or franchise taxes.

- More Paperwork: You’ll need to file Articles of Organization and create an operating agreement.

- Sole Proprietorship:

- Low Cost: No formal registration is required (unless you use a trade name).

- Minimal Paperwork: You only need to report income on your personal tax return.

Pro Tip: If you’re on a tight budget and want to keep things simple, a sole proprietorship might be the way to go.

4. Credibility and Professionalism

Your business structure can impact how customers and partners perceive your business.

- LLC:

- Professional Image: Having "LLC" in your business name adds credibility and trust.

- Investor Appeal: LLCs are often seen as more established and scalable.

- Sole Proprietorship:

- Less Formal: While still legitimate, sole proprietorships may be viewed as smaller or less professional.

Pro Tip: If you’re targeting larger clients or investors, an LLC can give you a competitive edge.

5. Management and Control

How much control do you want over your business?

- LLC:

- Flexible Management: You can manage the business yourself or appoint a manager.

- Multiple Owners: LLCs can have multiple members, making it easier to bring in partners.

- Sole Proprietorship:

- Full Control: You make all the decisions without needing to consult others.

- Single Owner: Sole proprietorships are limited to one owner, which can limit growth opportunities.

Pro Tip: If you plan to run your business alone, a sole proprietorship offers simplicity. If you want partners or investors, an LLC is better.

6. Long-Term Goals

Your choice of business structure should align with your long-term vision.

- LLC:

- Scalability: Easier to expand, add partners, or attract investors.

- Perpetual Existence: The business can continue even if ownership changes.

- Sole Proprietorship:

- Limited Growth: Harder to scale without changing your business structure.

- Tied to Owner: The business dissolves if you retire, sell, or pass away.

Pro Tip: If you envision growing your business into a larger operation, an LLC is the better choice.

7. Privacy

Privacy is another consideration, especially if you want to keep your personal information confidential.

- LLC:

- More Privacy: Some states allow you to keep member names off public records.

- Registered Agent: Using a registered agent service can further protect your privacy.

- Sole Proprietorship:

- Less Privacy: Your name and business information are typically public.

Pro Tip: If privacy is important to you, an LLC offers more protection.

Final Thoughts

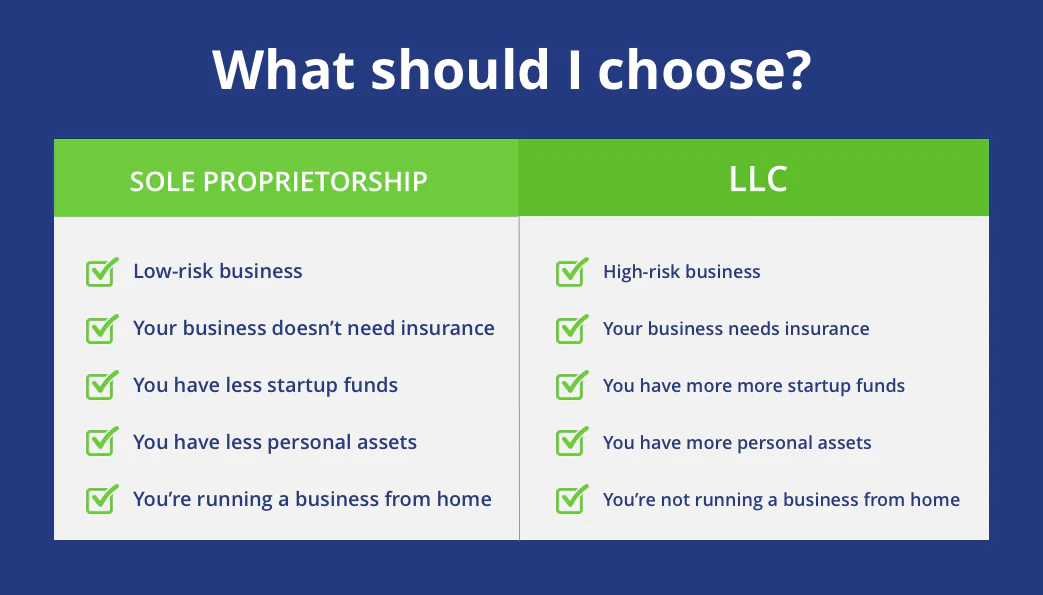

Choosing between an LLC and a sole proprietorship depends on your specific needs and goals. If you want liability protection, tax flexibility, and a professional image, an LLC is the way to go. On the other hand, if you prefer simplicity, low costs, and full control, a sole proprietorship might be the better option.

Take the time to evaluate your business plans, consult with a legal or tax professional if needed, and make the choice that sets your business up for success. Here’s to making the best decision for your entrepreneurial journey!